Fundraising in 2025 has become increasingly challenging, with U.S. venture capital at a 6-year low and investors adopting a more cautious approach. However, understanding and avoiding common pitch mistakes can significantly improve your chances of securing funding. Here are seven critical errors that could be sabotaging your fundraising efforts and practical solutions to fix them.

Mistake #1: Rushing Your Pitch Without Building Trust

Many founders make the critical error of rushing through their presentation, failing to build proper rapport and trust with investors. This often stems from nervousness or trying to cram too much information into a limited timeframe.

The problem? Investors aren't just evaluating your business: they're evaluating you. When you rush, you come across as unprepared or anxious, which raises red flags about your ability to handle the pressures of running a startup.

How to Fix It: Take time to properly prepare and practice your delivery. Start your presentation by establishing credibility and connection. Share a brief, compelling personal story about why you're the right person to solve this problem. Slow down your pace and ensure each key point lands before moving to the next. Practice with a timer, but don't sacrifice clarity for speed.

Remember: investors would rather hear a concise, well-delivered pitch than a rushed data dump.

Mistake #2: Vague or Missing Funding Ask

One of the most damaging mistakes is failing to clearly state your funding requirements or being ambiguous about how you'll use the money. Some founders shy away from stating their ask entirely, while others provide only vague descriptions like "we need money for growth."

This uncertainty makes investors question your planning abilities and business acumen.

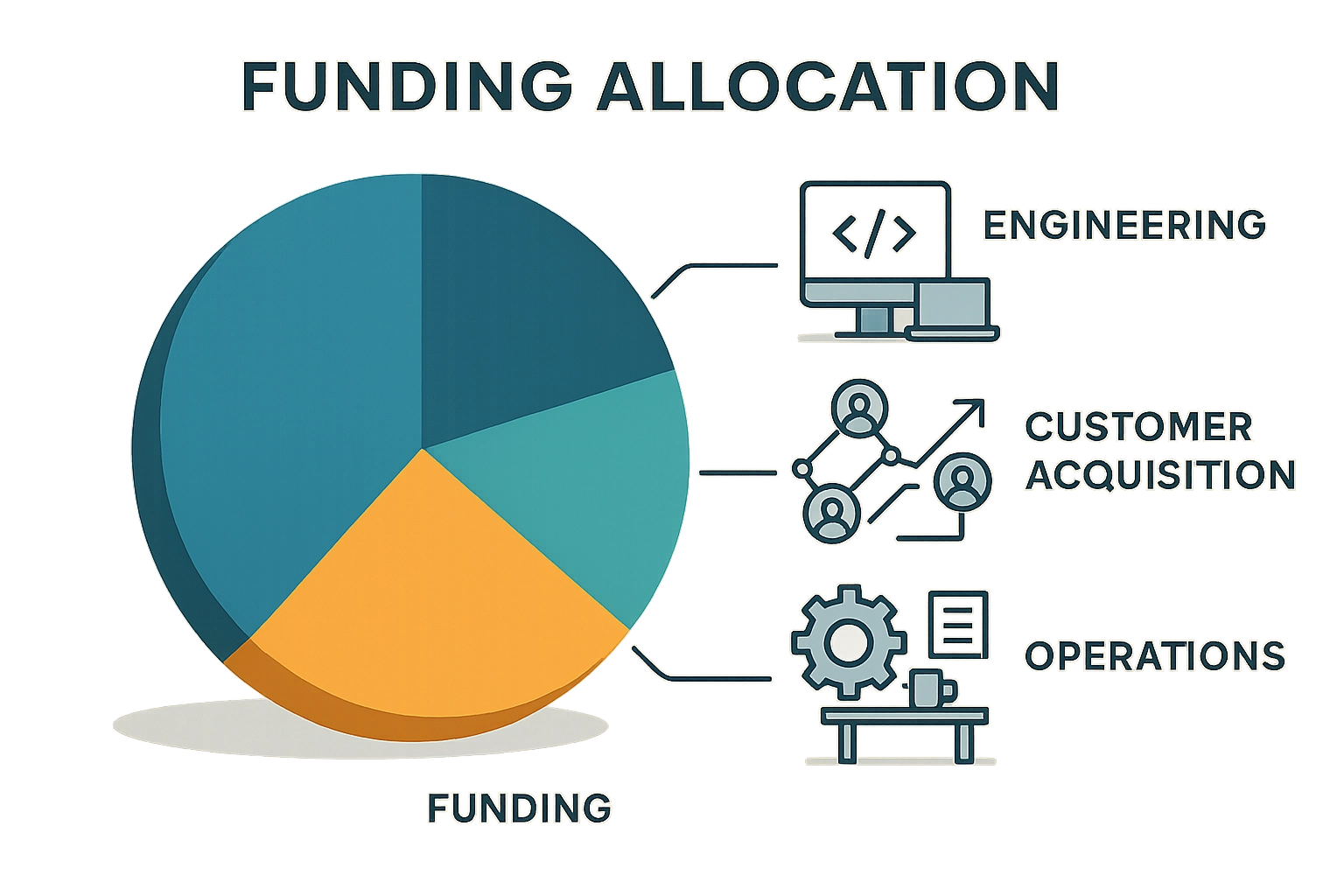

How to Fix It: Be bold and precise with your funding request. Your funding slide should clearly answer three questions:

- How much money do you need?

- What specific activities will this capital fund?

- What measurable milestones will this investment unlock?

For example: "We're seeking $1.2 million to achieve 18 months of runway. This breaks down to $500K for engineering talent to complete our MVP, $400K for customer acquisition, and $300K for operations and runway."

Mistake #3: Drowning Investors in Jargon

Technical jargon and industry buzzwords create barriers to understanding, especially when presenting to investors who may not have deep domain expertise. This is particularly problematic during early funding rounds where investors need to quickly grasp your concept.

Using complex terminology might make you sound smart, but it often leaves investors confused and disengaged.

How to Fix It: Prioritize clarity over cleverness. Speak plainly using simple words and short sentences. When you must use technical terms, define them immediately. Use analogies or metaphors to explain complex concepts: think "Uber for X" or "Netflix of Y" (though sparingly).

Test your pitch on someone outside your industry. If they can't understand what you do within 30 seconds, you need to simplify further.

Mistake #4: Failing to Show Real Traction

Investors fund momentum, not just ideas. A critical error is presenting your startup without evidence of traction or early market validation. This leaves investors wondering whether there's actual demand for your product.

In 2025's competitive landscape, ideas alone won't cut it. Investors want to see proof that people will pay for your solution.

How to Fix It: Include concrete evidence of market interest in your pitch. This can include:

- Early revenue or pre-orders

- Pilot customers and their feedback

- User signups and engagement metrics

- Strategic partnerships

- Press mentions or industry recognition

- Customer testimonials or case studies

Even pre-launch startups can show validation through customer discovery interviews, survey results, or prototype feedback. The goal is proving you're building something people actually want and will pay for.

Mistake #5: Unclear Product Development Timeline

Tech startups frequently struggle to clearly communicate where their product currently stands versus future plans. Investors often can't distinguish between what's built, what's in development, and what exists only in planning phases.

This confusion makes it impossible for investors to assess technical risk and timeline feasibility.

How to Fix It: Create a realistic product roadmap that clearly delineates current capabilities from future development. Use visual aids to show:

- What's live and functional today

- What's in active development (with specific completion dates)

- What's planned for future releases

- Key technical milestones and dependencies

Be honest about technological challenges and your team's ability to execute. Investors prefer realistic timelines over overly optimistic ones that you'll inevitably miss.

Mistake #6: Ignoring the "Why Now?" Question

Investors consistently ask themselves why your product is relevant specifically in 2025. Failing to address timing and market readiness is a significant oversight that can derail your pitch.

Great ideas that come too early or too late still fail. You need to prove this is the right moment for your solution.

How to Fix It: Clearly articulate what makes this the perfect time for your solution. Address factors like:

- Relevant market trends or shifts

- Regulatory changes that create opportunity

- Technological developments that enable your solution

- Changes in consumer behavior or expectations

- Economic conditions that favor your approach

Create a compelling narrative around why waiting would mean missing the opportunity window, while also showing why previous attempts at solving this problem failed.

Mistake #7: Unrealistic Financial Projections

Incorrectly estimated budgets and overly optimistic revenue projections without supporting details serve as major red flags for investors. This includes projections that ignore customer acquisition costs, lack unit economics, or disconnect from your product roadmap.

Hockey stick growth charts without underlying assumptions make you look naive rather than ambitious.

How to Fix It: Develop clear, well-reasoned financial models that include:

- Realistic revenue projections backed by unit economics

- Customer acquisition costs and lifetime value calculations

- Clear assumptions behind your growth projections

- Budget breakdown that connects to your roadmap

- Multiple scenarios (conservative, base case, optimistic)

- Comparable metrics from similar companies

Be prepared to defend every number in your projection. If you can't explain how you arrived at a figure, remove it.

Beyond the Big Seven: Additional Pitfalls to Avoid

While these seven mistakes are the most common, also watch out for:

- Using weak language like "we think" or "maybe" instead of confident assertions

- Making broad claims without specific supporting data

- Focusing on features instead of customer benefits

- Ignoring competition or claiming you have none

- Presenting a disorganized or hard-to-follow slide deck

The Path Forward

Successful fundraising in 2025's challenging environment requires meticulous preparation, clear communication, and genuine market momentum. Each of these mistakes represents a missed opportunity to build investor confidence.

The good news? These issues are entirely fixable. By addressing these seven common pitfalls, you'll significantly improve your chances of capturing investor interest and securing the funding your startup needs to thrive.

Remember: investors see dozens of pitches every week. Standing out means avoiding these preventable mistakes while clearly demonstrating why your solution, team, and timing create an unmissable opportunity.

Your pitch isn't just about raising money: it's about proving you have what it takes to build a successful company. Make every slide count.